Avoid surprises! Detailed analysis of B1B2 visa US summer camp insurance

It’s the peak season to prepare for overseas study tours and summer camps! Although there are many benefits to studying abroad, the importance of insurance cannot be ignored when you are in a foreign country. Today, we will introduce to you in detail the insurance types and related precautions of summer school medical insurance.

1. Don’t ignore overseas travel medical insurance just because you have basic medical insurance in your country of origin. The two have very different protections.

2. Don’t ignore medical insurance just because you have accident insurance. Only when you have both can you get more comprehensive protection.

3. Don’t wait until you are about to travel to buy it. It’s best to buy it a few days in advance.

4. Don’t just copy other people’s insurance plans.

5. Don’t just look at the price and ignore the protection.

6. Don’t think that having travel agency liability insurance is enough. It doesn’t cover personal negligence.

1. Time limit for stay (some insurance needs to be purchased before landing in the United States, or there are other time requirements);

2. Do you need to pay in advance ?

3. Can it be renewed? How long can it be renewed to avoid suddenly extending the trip but not being covered.

4. What is the compensation ratio ? Make sure you can report as much as possible.

5. Does it include emergency room, ambulance, and hospitalization ? These are the most important items.

6. Does it include urgent care to avoid sudden accidents.

7. What are the network providers (there are price agreements in the network, which is more secure. Please try to choose the provider in the network).

8. Is it a PPO ? (Do you report outside the medical network?).

9. Are there other restrictions in individual states (such as Maryland) ?

Buy quality US travel medical insurance now .

1. Accidental injuries and first aid: Summer camp activities usually include outdoor sports, and the risk of accidental injuries is higher. Make sure the insurance covers these situations.

2. Medical expenses for illness: including doctor’s consultation fees, hospitalization fees, drug costs, etc.

3. Emergency medical transportation: Make sure the cost of emergency medical transportation to the hospital or repatriation is included.

4. Specific activity coverage: Summer camps may include high-risk activities (such as rock climbing, swimming, etc.), make sure these activities are within the scope.

5. Emergency service: Provide 24-hour emergency contact service, you can ask for help at any time.

6. Simple claims process: Understand the insurance company’s claims process and required materials to ensure that you can get compensation quickly when needed.

7. Make sure to comply with local laws and summer camp requirements in the United States. Some summer camps may have specific requirements.

Choose a considerate and reliable summer school travel medical insurance for your child now

1. It meets the requirements of summer camp insurance, and also has these highlights: multiple cooperative hospitals, no need to advance payment, direct settlement, saving the trouble of reimbursement, especially suitable for short-term summer camps, travel, and visiting relatives.

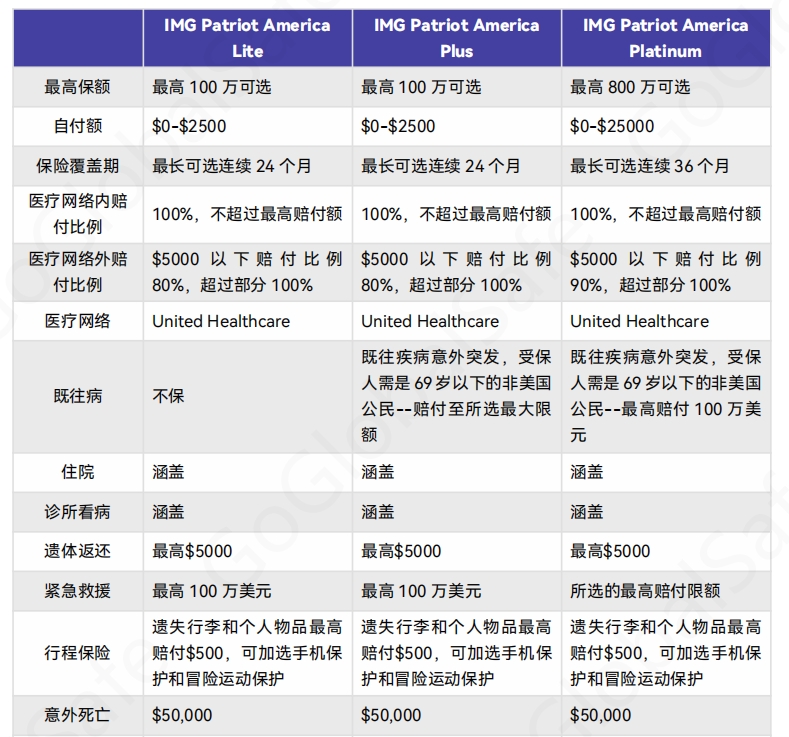

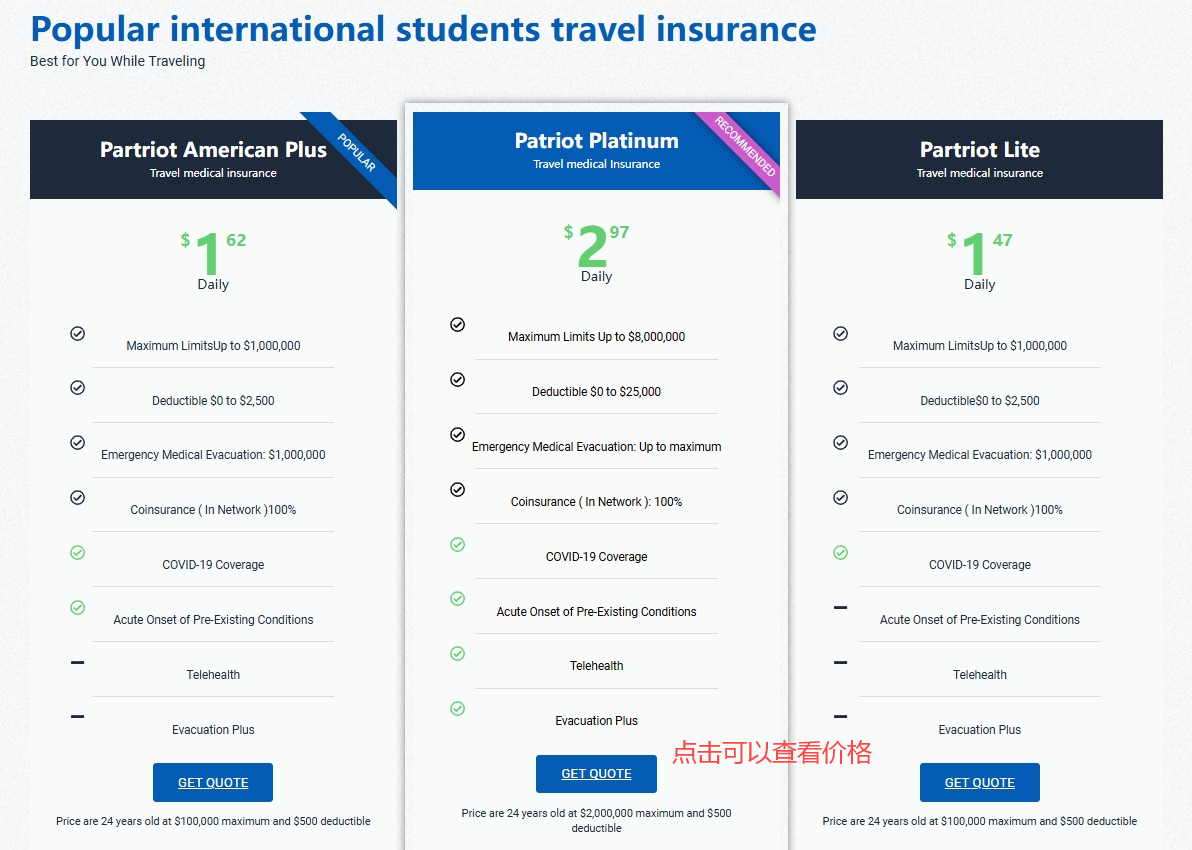

2. General travel medical insurance covers the following content, and the compensation ratio for hospitalization, surgery, outpatient, and emergency may not be 100% covered. In addition to the above content, GoGlobalSafe (GGS)’s IMG Patriot travel series will also cover travel insurance, body return, and a higher compensation ratio (the compensation ratio within the medical network reaches 100%), and insurance for previous diseases (also suitable for traveling with elderly family members and configuring for them).

3. PPO, the largest medical network in the United States, United Health Care, can be covered both within and outside the medical network.

4. If you originally bought a one-month summer camp coverage, you still want to play for a few more days after you arrive. Can you renew the insurance? Of course you can.

5. It can cover the new crown: you can be covered after the new crown is diagnosed.

6. Property loss compensation: Lost luggage and personal belongings are compensated up to $500. If property such as luggage, documents, cash, electronic products, etc. are lost or damaged during the trip, compensation can be obtained.

7. Mobile phone protection and adventure sports protection: These are two optional additional services, which are very suitable for children participating in summer camps.

Q: If you already have accident insurance, do you still need to buy travel medical insurance?

A: It is recommended to buy one, after all, travel insurance is more comprehensive in terms of protection.For example: many travel insurances can cover high-risk sports, acute diseases, financial losses, emergency rescue, etc., but ordinary accident insurance does not cover them, especially emergency travel abroad, and ordinary accident insurance does not cover accidents abroad at all;

Q: If you already have medical insurance in China, do you still need to buy travel medical insurance?

A: In many cases, the basic medical insurance in your country of origin rarely or does not cover the medical expenses caused by your travel abroad.

Q: If the travel agency has bought insurance, do you still need to buy travel medical insurance separately?

A: Generally, the insurance bought by travel agencies is of the following two types:Travel agency liability insurance: only protects the losses of tourists caused by the travel agency due to negligence, and does not compensate for the liability caused by the tourists themselves.Tourist accident insurance: protects the personal risks of tourists during their travels, but the insurance amount is usually not high and the protection is not comprehensive.

Buy quality US travel medical insurance now

Check out the following resources for information and advice on traveling to the United States or U.S. travel insurance.

US Department of State website about US travel

U.S. Customs and Border Protection official website

Transportation Security Administration official website

GoGlobalSafe has provided services to more than 10,000 customers, providing comprehensive and reliable protection plans for people going abroad with different needs. Whether you are traveling, studying, studying abroad, interning or working abroad, you can find insurance products and solutions suitable for you at GoGlobalSafe.

GoGlobalSafe provides insurance services for international students around the world. GoGlobalSafe cooperates with local companies in various countries to provide more cost-effective insurance plans for international students.

If you have any pre-sales or after-sales questions, you can contact our customer service!